As finance professionals and entrepreneurial investors, we see artificial intelligence everywhere—it’s the AI theme driving massive capital appreciation in a handful of tech giants.

But the real AI revolution in our field isn’t just about investing in AI companies. It’s about AI making investments on our behalf.

This is a complete paradigm shift. And it’s happening inside a vehicle you already know: the Exchange-traded fund. The rise of AI-driven ETFs represents a new frontier in active management, moving beyond simple quant screens and into the realm of true algorithmic decision-making.

This post will provide a practical framework for understanding and analyzing this new asset class. You’ll learn the critical difference between funds that invest in AI and funds that are AI, see exactly how these algorithmic funds use machine learning for stock selection, and gain a clear-eyed perspective on their performance, risks, and future.

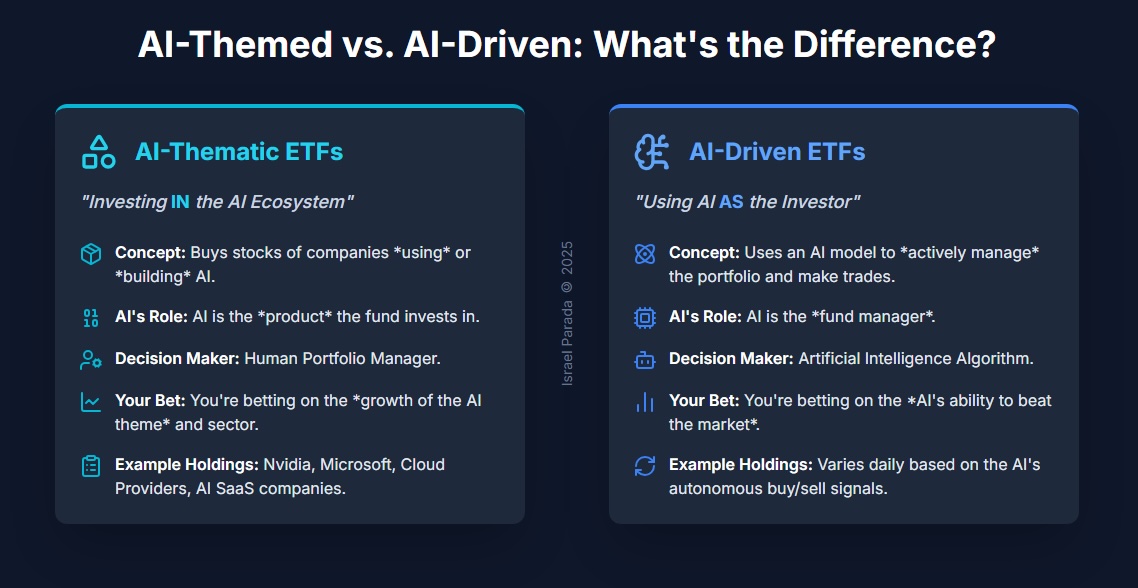

The critical distinction: AI-driven vs. AI-thematic ETFs

In the rapidly expanding ETF space, “AI” is used as a marketing buzzword. This use creates a critical point of confusion that many investors, including financial news outlets, get wrong.

Your first job as an analyst is to separate the two.

(Image provided by Author)

AI-thematic funds: Investing in the AI ecosystem

This is the category most investors are familiar with. These are traditional ETFs in structure, just focused on a specific theme.

An AI-thematic fund invests in the AI ecosystem. Think of it as buying the “picks and shovels” of the AI revolution, companies that develop gen AI tools and technologies. Its top holdings will include the companies you expect:

- Companies in sectors like health care or autonomous vehicles that are using AI technologies

- Cloud providers and data centers that supply the computing power

- The semiconductor technology companies building the GPUs

- Firms in general, with a clear focus on AI research

- Developers of generative AI and AI models

According to the FinTech journal, the investment decisions in AI-themed ETFs are still made by human portfolio managers. And, their performance is driven more by asset selection than by active management strategies.

AI-driven ETFs: Using artificial intelligence for investment decisions

This is where the paradigm shifts.

In true AI-Driven ETFs, the artificial intelligence is not the investment—it’s the investor. These are almost exclusively actively managed funds (or a new era of active funds) where an AI model acts as the fund manager.

No human is making the day-to-day buy/sell calls.

While the technology offers significant advantages, it’s essential to consider the AI development cost involved in creating these sophisticated systems. A well-known example is the AI-Powered Equity ETF (AIEQ), which uses IBM Watson’s computer science capabilities to build its portfolio.

This is a fundamentally different product. You’re not betting on the AI theme; you are betting on a specific AI’s ability to beat the market. That’s what the rest of this blog post is about.

How AI-powered ETFs work: A look under the hood

So, how does AI actually manage a multi-million dollar portfolio?

It’s a scalable process that mimics, and in some ways, exceeds the workflow of a massive quantitative hedge fund.

The data advantage: Processing billions of data points

A human fund manager can read a few analyst reports, scan the headlines, and review financial statements. AI can do that for almost every listed company on earth in a fraction of the time.

AI funds are built on a “big data” premise. They scan and interpret billions of structured and unstructured data points in real-time. This includes:

- Global market conditions and economic data

- Every SEC filing and financial statement

- All financial news and press releases

It can even analyze satellite imagery of parking lots or shipping lanes.

The role of machine learning and natural language processing

Processing data is useless without interpretation. This is where machine learning (ML), Natural Language Processing (NLP), and generative AI come in.

Machine learning algorithms sift through all that data to find predictive patterns and correlations that are invisible to the human eye. It might find that a certain phrasing in a CEO’s earnings call, combined with a specific change in inventories, has preceded a stock drop 80% of the time over the past decade.

Natural Language Processing (NLP) is the engine that reads and “understands” human language. It scans millions of social media posts, news articles, and reports to gauge market sentiment. It doesn’t just count keywords; it interprets tone, sarcasm, and context to build a real-time map of investor emotion, moving far beyond traditional analyst reports.

From AI models to active stock selection

This is the final step. The AI models take all this processed data—the quantitative, the sentiment, the macro picture. And weigh it all.

The output is simple: Buy, sell, or hold.

This system effectively automates the entire stock selection process for the fund’s equity securities. It’s a form of active management executing its AI-driven strategies 24/7, free from:

- Human bias

- Greed

- Fear

Analyzing AI-driven ETFs: Strategy, performance, and risk

When analyzing AI-powered ETFs, you must be even more skeptical than usual. Remember, investing involves risk, and new technologies often introduce new, unforeseen risks.

AI funds vs. traditional ETFs and actively managed funds

To understand their role, let’s compare them directly. AI-powered ETFs create a new middle ground, blending attributes from both passive and active investing.

| Feature | Traditional Passive ETF | Human-Run Active Fund | AI-Driven ETF |

| Strategy | Tracks an index (e.g., S&P 500) | Human fund manager discretion | An AI model makes stock selection |

| Expense Ratios | Very low | High | Moderate to High |

| Transparency | High (holdings are known) | Varies (strategy can be opaque) | “Black Box” (process is proprietary) |

| Human Bias | None (rules-based) | High (emotional, cognitive) | None (but has model risk) |

The core takeaway is that AI funds aren’t cheap. They often carry expense ratios similar to those of human-managed funds to cover the costs of AI development and computer science talent. Furthermore, AI doesn’t necessarily invest the same way humans do. Many investors today incorporate ESG factors into their investment decisions; it’s important to consider that an AI might not make the same choices under the same circumstances.

Analyzing AI-driven ETF performance

The disclaimer of “past performance doesn’t guarantee future results” is more important here than ever, as the AI statistics show.

The trading history for AI ETFs is short. Most are in their early stages with less than a decade of performance data. This short history means their AI models have not been thoroughly tested by diverse, long-term market cycles, such as a major recession or a stagflationary period.

Consequently, there’s little research comparing AI-driven ETFs with human-managed funds.

In fact, most studies on the effectiveness of AI-driven investing focus only on three distinct international market-altering events:

- The Silicon Valley Bank (SVB) collapse

- The COVID-19 pandemic

- The Ukrainian conflict

The performance data so far is mixed.

According to Iina Wilenius, AI-managed funds outperformed human-managed funds during the early stages of the Ukrainian war, while human-managed funds performed better during the SVB collapse.

(Image provided by author)

The Future Business Journal also reported that AI-driven equity funds perform better during market downturns, while human-driven funds perform better during market uptrends. They based the assessment on risk-adjusted return metrics such as Sharpe, Jensen’s alpha, and Treynor.

While these results do not directly extrapolate to ETFs, they indicate a clear sign that AI can help mitigate risk in certain types of investments during highly volatile market conditions.

These insights fundamentally change how the average investor views AI-driven investment decisions: They serve as additional tools in your belt, not a standalone solution to your ETF woes.

That said, most authors point out that we still need much more research to better understand where and how AI improves investing in practice, not just in theory.

The AI-model risk factor

With AI-driven ETFs, you’re exposed to unique risks you won’t find in a large-cap momentum ETF.

- “Black box” risk: The biggest risk is that AI models are like a black box: Inputs go in; investing decisions come out; but you will never know why the fund bought or sold a security. If the fund suddenly underperforms, you have no thesis to check, no managing director to question. You only know the algorithm failed.

- Model risk: All AI models are trained on past performance. If the market enters a new era (such as the 2022 rate-hike cycle), the AI’s historical data may become useless, leading it to make poor investment decisions.

- Flash-crash risk: What happens if thousands of AI funds are all using similar data and AI-driven strategies? It could lead to one-sided, herd-like behavior, creating higher volatility and “flash crashes” in the securities markets.

This isn’t a simple problem to fix. It’s a structural reality of this new technology.

The future of the ETF industry: Are AI fund managers the new normal?

The AI revolution is clearly not a fad. But will it completely take over the ETF industry?

The AI revolution in the ETF space: Tracking assets under management

The growth of active ETFs is undeniable, with assets under management (AUM) in the category reaching the $1.73 trillion mark by the end of September 2025 (source: ETFGI).

AI-driven ETFs are a small but rapidly growing segment of the active ETF market. For example, AIEQ has $118 million in AUM as of H3, 2025.

Our final opinion on AI-driven investing

Here’s the bottom line: AI-driven ETFs are not a gimmick. They represent a significant and permanent evolution in active management.

Their very existence challenges the idea that a human fund manager is the only way to manage assets actively. However, they are not a silver bullet that guarantees future results.

They are a powerful new tool. For finance professionals, they offer a new way to potentially generate alpha, free of human emotional bias. But they come with their own unique and complex risks.

To stay ahead of these trends and get expert insights on new investment opportunities—from AI funds to private deals—delivered straight to your inbox, subscribe to the Investing.io weekly newsletter.